Press Releases

- Article

FERRETTI S.p.A. - Sailing Through Rough IPO Seas

May 13, 2022

By Frederick Chann

Ferretti (9638.HK) is a designer and manufacturer of luxury composite yachts, made-to-measure yachts and superyachts under brand names such as Riva, Wally, Ferretti Yachts, Pershing, Itama, CRN and Custom Line. The company operates six shipyards in Italy and sells to customers in more than 70 countries.

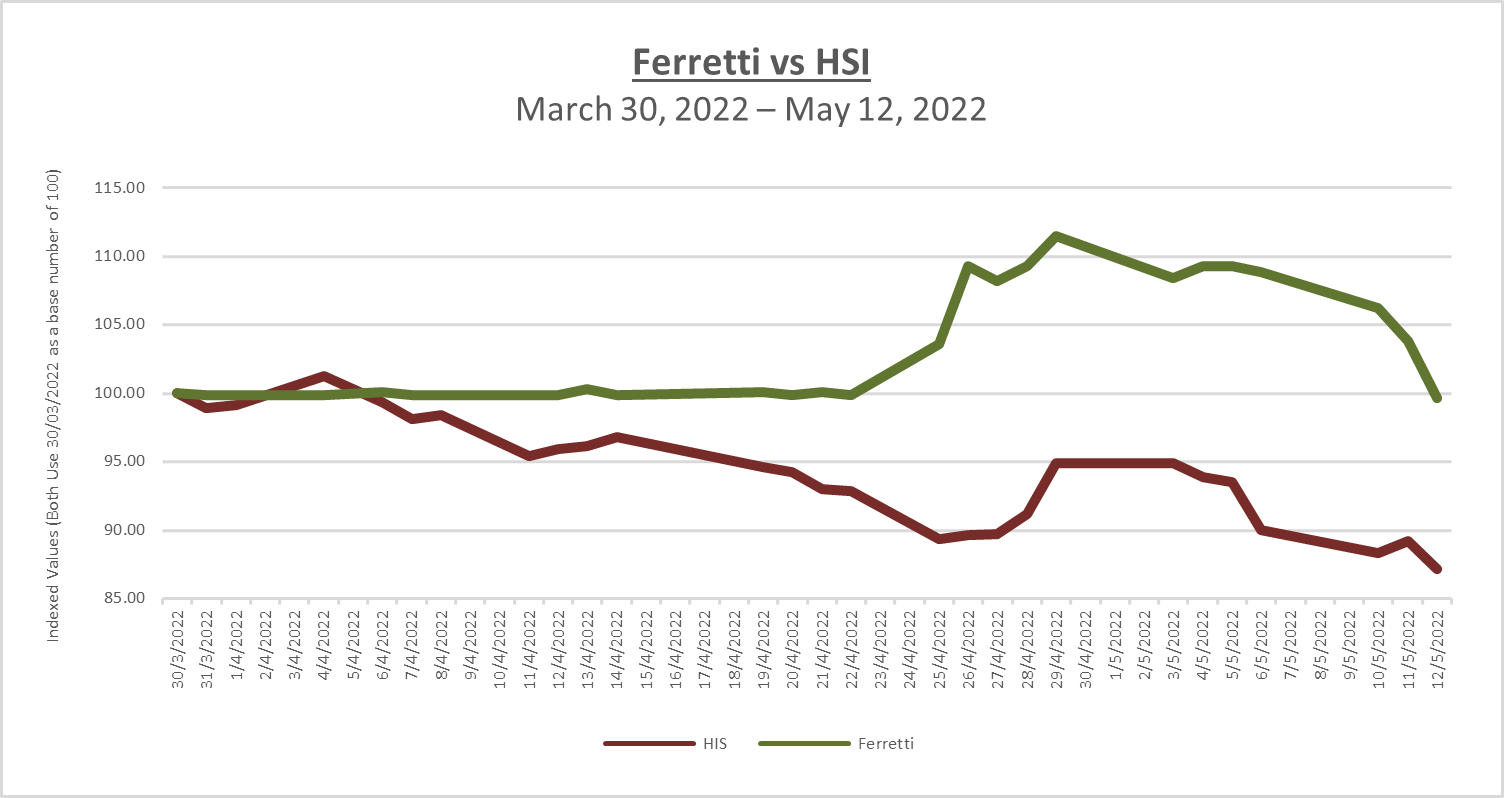

Ferretti completed its IPO on March 31, 2022. Not only was it accomplished in what could only have been characterized as an extremely challenging market, its share price has significantly outperformed the Hang Seng Index (“HSI”). This case study presents what likely deliberations took place at various stages in Ferretti’s boardroom and the many factors that collectively made its IPO possible.

Storm Brewing (Q1 – Q2 2021)

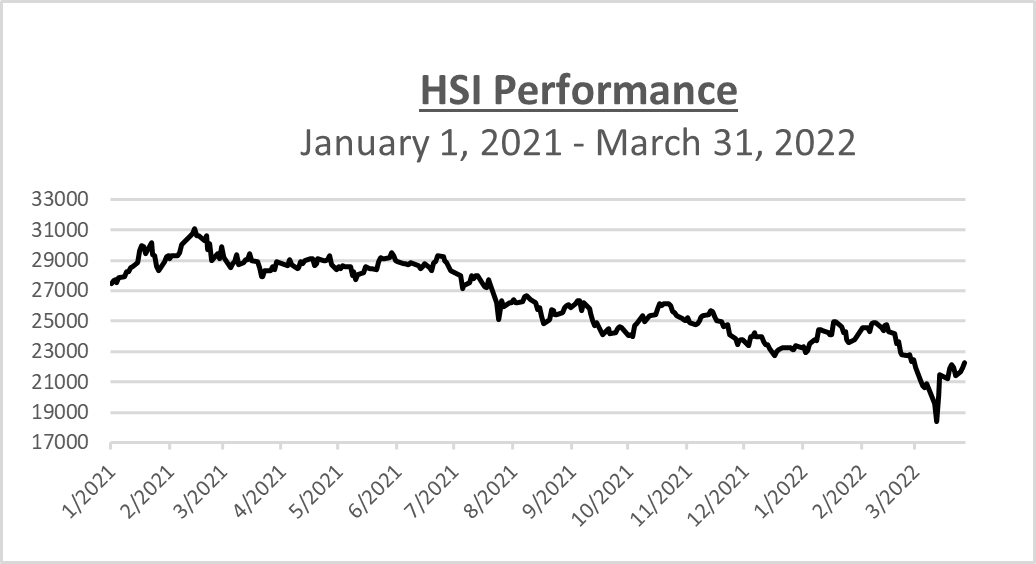

- On February 18, 2021, the Hang Seng Index (“HSI”) reached an intra-day high of 31,183, the highest level since June 2018.

- Over the next 4½ months, HSI fell by 7-10% and hovered around 28,000 – 29,000.

- During this period, Ferretti’s board would have had to approve ramping up IPO preparations. It should have been an easy “Go”.

Skies Darkening (Q3 – Q4 2021)

- When the company would have been close to filing its listing application at the end of Q3, HSI had steadily declined to around 24,000 (i.e. by a further 14-17%).

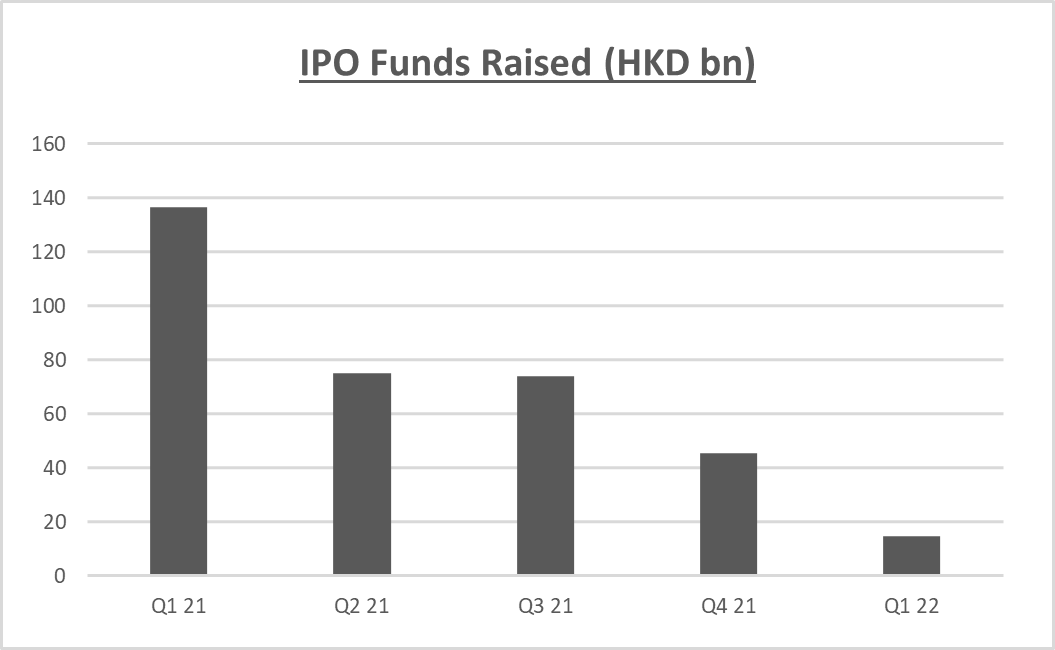

- The IPO market was still robust enough with HK$75 bill. raised in each of Q2 and Q3 (source: HKEx).

- Plenty of time and tens of millions in professional fees had already been sunk.

- Ferretti’s board now had a tougher, though still rather straight-forward, decision to make.

- Proceed with the listing application, ready the IPO for the spring and hope for a market upturn.

- Meanwhile, IPO funds raised dropped in Q4 by almost 40% (source: HKEx). And the worst had yet to come!

Storms Hit (Q1 2022)

- January proved to be the (brief) calm before the storms – not one, not two, but three!

- The resilient US market (S&P 500) started to fall from its all-time high of 4,818.

- After 2 years of being the poster child of COVID-19 control, Hong Kong experienced a sharp 3-week spike starting in mid-February. Case numbers stayed elevated for another 2 weeks.

- Meanwhile, Russia invaded Ukraine on February 24, 2022. Oligarchs and their superyachts suddenly became a focus under sanctions by the US, EU, UK, etc.

- Even though Ferretti did not have any pending orders from Russian oligarchs and would cease to enter into any sales contracts with Russian and Ukrainian purchasers, it was an untimely distraction – i.e. one extra potential investor concern to have had to address.

- This would have been around the time when Ferretti’s auditors finished their year-end audit.

- The prospectus would have been updated and the IPO ready to be launched …. save for one critical factor – the market!

- HSI fell to as low as 18,235 (intra-day on March 15, 2022, another 20%+ drop since September).

- No doubt the board had had numerous fist-wringing moments during this time:

- We had already pulled from one IPO attempt (back in 2019 because of unsatisfactory valuation). We are now in an even tougher market. Do we hold off?

- If we do, what is the likelihood of market conditions improving meaningfully in the near term?

- How long can we hold off for? By June 30, we will have to update our financials. Given geopolitical and global economic developments, what will our H1 2022 numbers look like?

- Months of preparation and tens of millions of professional fees had already been sunk. We need the IPO to finance our business plans. Should we take a shot?

- If we do and fail, what are the implications?

Wind in Ferretti’s Sails

- In the end, the board decided to proceed, no doubt with the considered advice of nervous underwriters.

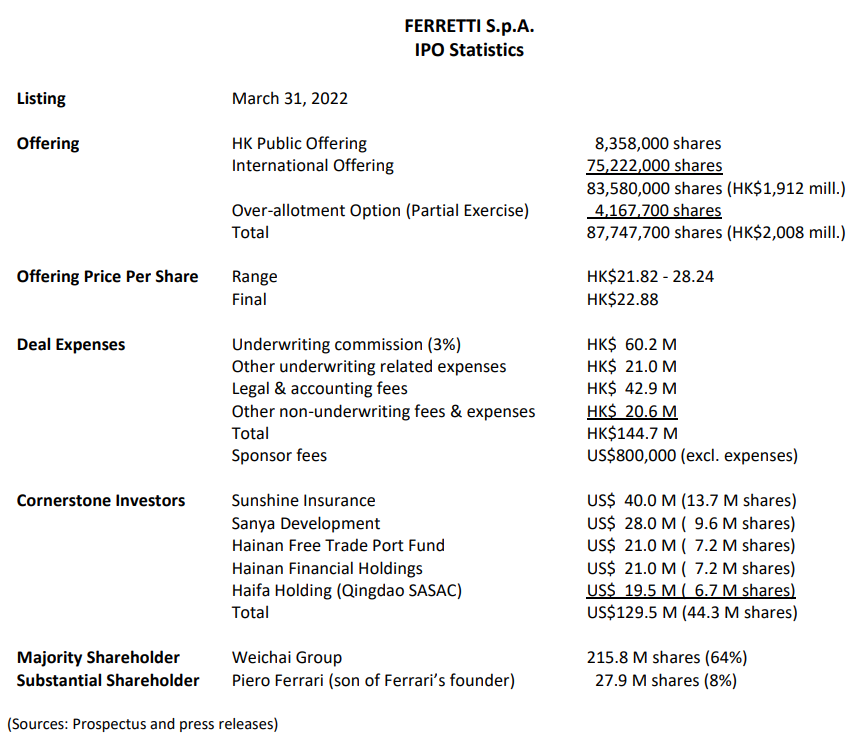

- The IPO, at an offer price between HK$21.82 and HK$28.24 per share, was announced on March 22, 2022.

- This decision took guts. Had it not been for the many “ticks” that had been checked off, I very much doubt that the directors would have voted for a go-ahead:

- Market to itself – there was no other major IPO being marketed so Ferretti had maximum investor attention;

- Scarcity value – there are few listed comparables (notably Sanlorenzo (SL.MI)) and none on SEHK;

- Strong majority shareholder with substantial resources (Weichai);

- Cornerstone investors – five committing a total of US$130 mill. regardless of share price (as long as it was within the offer range);

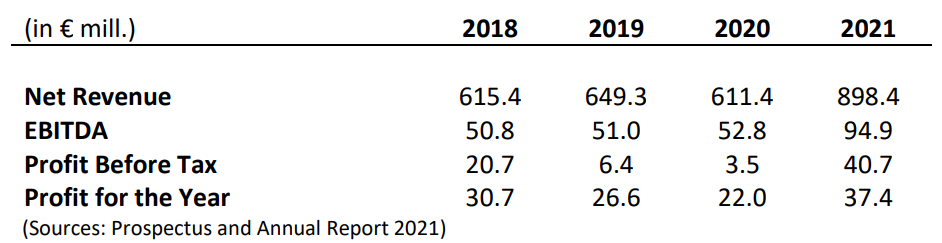

- Net revenue growth – 47% YoY;

- Profitability growth – YoY EBITDA and profit for the year growth of 80% and 70% respectively;

- Dividend paying – Ferretti will be paying out not less than 30% of profits (after deduction of 5% mandatory legal reserves) to shareholders; based on 2021 profits of euro 4 mill. and IPO valuation (@$22.88 / share) of HK$5.74 bill. (approximately 700 mill. euro) (pre-money), a dividend yield in the 1.5% range could be expected … not high, but should have helped; and

- “Over-sized” over-allotment option (or “greenshoe”) – with half of the IPO already spoken for by the cornerstone investors and subject to lock-ups, there was plenty of “ammunition” for market stabilization to reduce the risk of sharp declines in the first 30 days post-pricing.

Seal the Deal

- Nevertheless, the IPO was still priced towards the low end of the offer range at HK$22.88 per share.

- Valuation might not have been ideal, but still a respectable 18.7x TTM P/E (pre-money) – especially considering how rough the market had been, and strong revenue and profitability growth had been only a single year occurrence thus far.

- By this time, the board’s decision should have been straightforward – get the deal done!

Post-Mortem

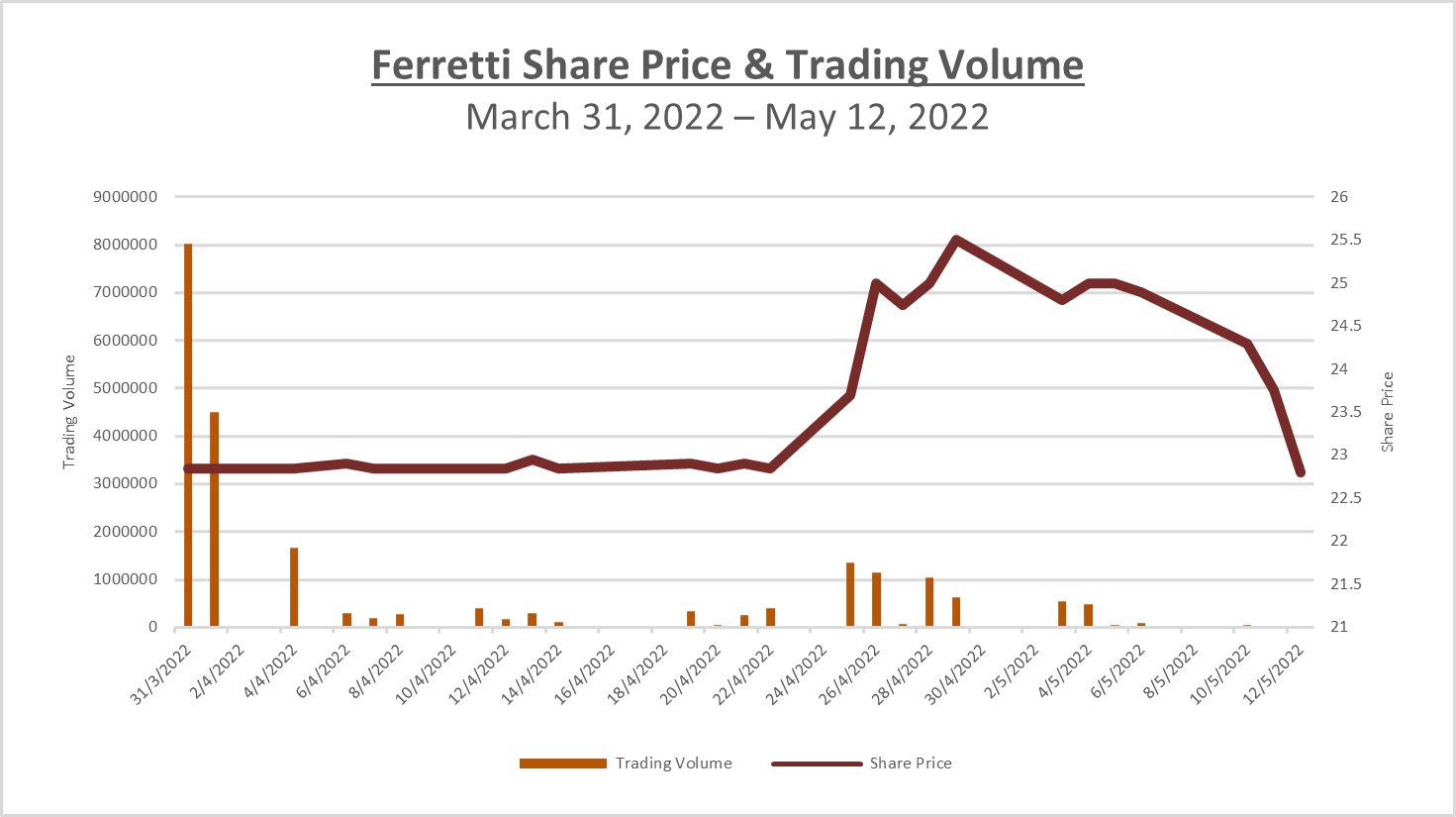

- Share price stayed stable thanks to the “over-sized” greenshoe, which was partially exercised on April 24.

- It rose to as high as $75 and closed at $22.80 on May 12, 2022 – slightly below the IPO price but still outperformed HSI by 12%.

- Overall , BRAVO!

Fred is a Director & Senior Advisor at Armor Capital. He advises C-suite executives and boards of directors on strategy development and planning, corporate governance, equity & debt financings, IPO preparation and M&A due diligence. In his consultancy practice, he draws upon two decades of experience in investment banking, fund management and entrepreneurship. Fred has also served on the boards of listed and private companies as well as NGOs, in capacities including Chair, Governance Committee & CFO. For 10 years, he was a Fellow of the Hong Kong Institute of Directors. He received both his BA (Hons.) & MBA (Dean’s Honour List) from the Ivey Business School (Canada).

fred@armor-capital.com / +852 9686 5928

Disclaimer:

No part of this publication may be reproduced or transmitted in any form or for any purpose without the express permission of Armor Capital. These materials are provided by Armor Capital for informational purposes only, without representation or warranty of any kind, and Armor Capital shall not be liable for errors or omissions with respect to the materials. Armor Capital declines any liability in relation to this information, nor shall it be liable for any decisions taken based on the information contained on this publication.