Sell-side Advisory

1. Strategic Assessment/Review

At Armor Capital, we thoroughly analyse your business, unveiling its strengths, weaknesses, opportunities, and threats. This evaluation ensures your readiness before embarking on the sales process, highlighting attractive aspects to potential buyers. We examine company filing to ensure a clear ownership structure and audited financial reports will be available.

Our team crafts a tailor-made program outlining objectives and actions specific to your company. We set strategic goals, define target markets, analyse competitive landscapes, and chart a roadmap for your successful sales journey.

Utilising our expertise, we help to determine your company’s maximum true value, considering financial performance, market dynamics, asset quality, intellectual property, and growth prospects. Accurate valuation is pivotal in setting an enticing price to attract motivated buyers.

We provide comprehensive coaching to you as business owners, from presentation and negotiations, presentations to emotional readiness for the transition, ensuring a confident and well-prepared stance throughout the sale process.

2. Going to Market

Armor Capital crafts engaging documents such as Teasers and Information Memorandums, spotlighting your company's history, financial prowess, market position, growth potential, and the rationale behind the sale. These materials captivate potential buyers' interest effectively.

Leveraging our experience and network, we selectively approach potential buyers. By assessing industry fit, financial capacity, synergies, and potential synergies from acquisition.

We guide you through presentations and all interactions with potential buyers, ensuring effective generation and alleviation of uncertainties.

We help to organise and compile all relevant documents within a secured Virtual Data Room (VDR) to facilitate information flow during the due diligence process.

3. Execution

We communicate tactically with potential buyers to generate multiple letters of intent (LOI) from the market. Our team dissects the Terms & Conditions of the offers and shortlist two to three for further negotiation.

We work hand-in-hand with the legal team on the negotiation of the sales and purchase agreement (SPA) to deliver the best possible terms for the business owner.

Armor Capital crafts a comprehensive Sale and Purchase Agreement (SPA). We also oversee transaction executions to ensure the transition of ownership and payment settlements and fulfill legal formalities for the deal’s finalisation.

M & A Timeline

M&A Review and Analysis

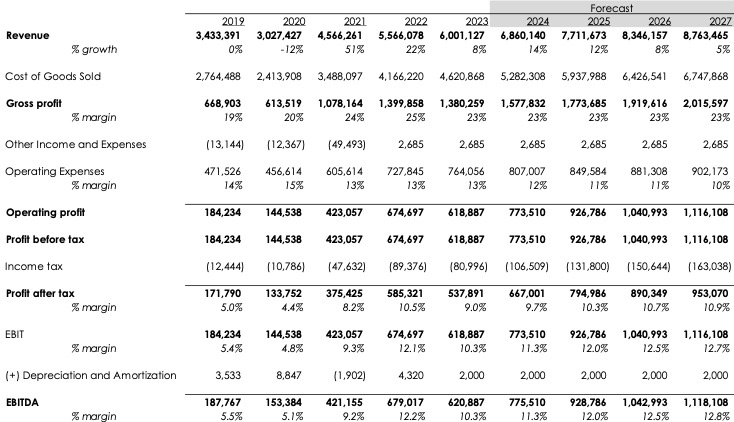

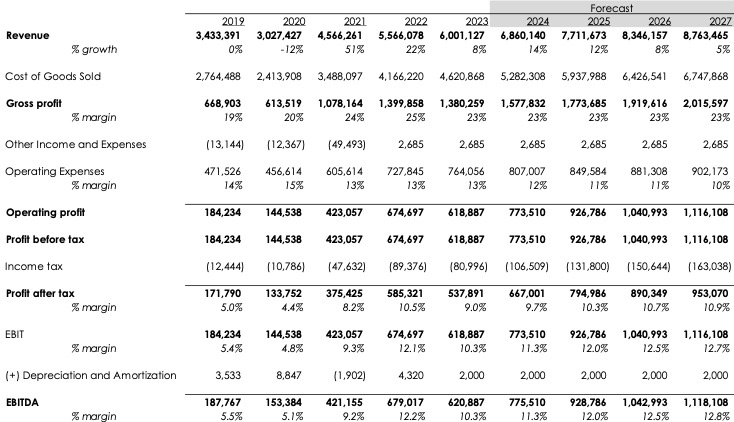

- Reviewing any previous financial statements and growth plan

- Key achievements

- Strategic review of the business

Stay up-to-date with Armor Capital?

Subscribe to our newsletter with occasional emails about news, investment and portfolio updates.

We do not spam and you can unsubscribe anytime.