Press Releases

- Article

APAC Paper Packaging Industry Report H2 2019

May 27, 2020

Introduction

We are pleased to share with you a summary update of market valuations and activities in the Asia Pacific Paper Packaging industry for the second half of 2019.

Paper Packaging is one of the key sectors which Armor specializes in and closely follows market trends. Please contact us for further discussions.

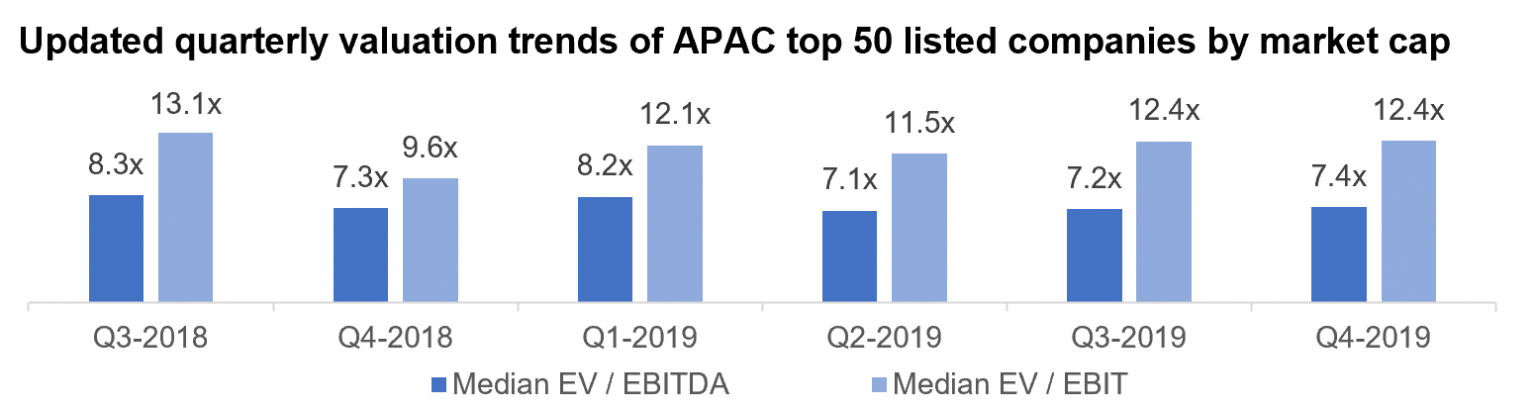

Valuations of Asia Pacific’s public companies have been relatively stable in H2-2019 compared to the same period in 2018. Median EBITDA increased slightly from 7.2x in Q3-2019 to 7.4x in Q4-2019 while EBIT remained the same at 12.4x.

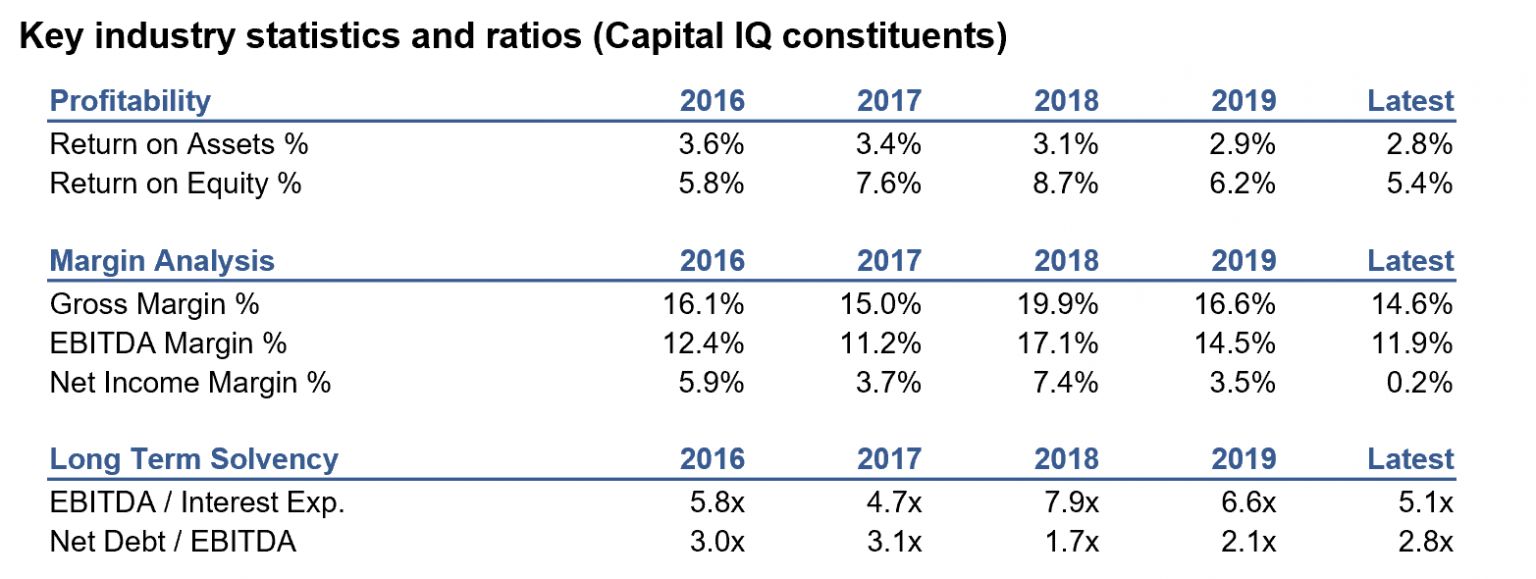

The table above reflects that industry margins are on a downtrend from its peak in 2018 (latest net income margin is 0.2% vs 7.4% in 2018). Over the same period, leverage of the industry constituents have increased. Returns have lowered in the recent years.

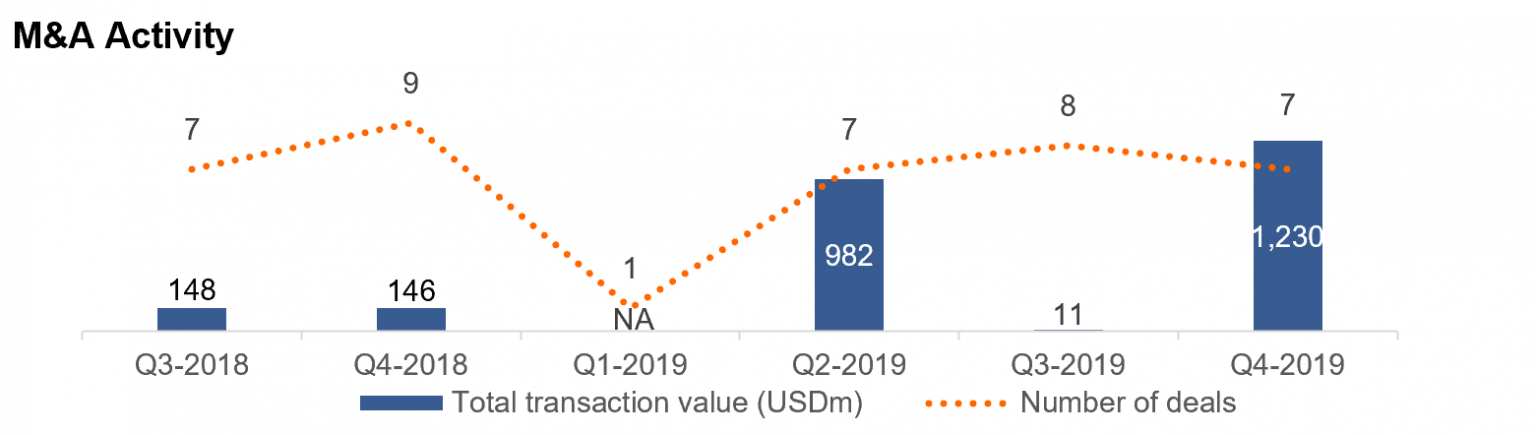

With the exception of Q1-2019, each quarter saw 7-9 deals in APAC’s Paper Packaging. Most of the deals were in the lower mid market segment, while in Q4-2019 a transaction in Australia drove most of the total transaction value (Australasian Fibre Business of Orora Limited – transaction value USD 1,163m), this was also the case for Q2-2019.

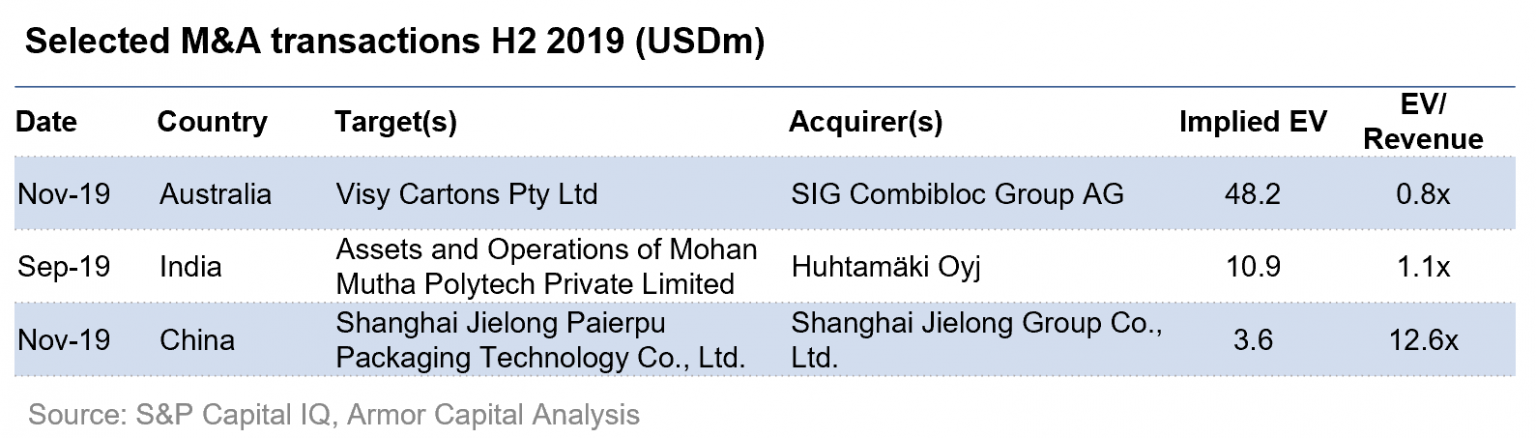

Armor selected the largest M&A transactions across the region in H2-2019 for which information on Implied Enterprise Value was available. Although the largest transaction by value was driven by an Australian deal (see above), the transaction details were private.

Paper packaging is one the key sectors in which Armor specializes and closely follows market trends.

Please contact us for an in-depth discussion via enquiry@armor-capital.com