Buy-side Advisory

1. Strategic Assessment/Review

We work closely with you to develop and your team a bespoke corporate growth strategy, aligning M&A activities with your company’s long-term business objectives to achieve sustainable growth, from customer/talent acquisition and geographical expansion to technology/capability enhancement.

We perform a deep dive into any previous M&A transactions for insights and learning. We conduct comprehensive post-deal analysis of your previous and existing M&A activities, if any, offering insights and learning to ensure informed decision-making in future acquisitions.

Armor-Capital delves into the intricacies of M&A deal rationale, emphasizing the value of synergies, whether operational, financial, or strategic, to ascertain the viability and potential benefits of the acquisition.

If necessary, we help explore various financing options available aside from equity. We also spend time with your team to anticipate potential risk elements post-acquisition, setting the groundwork for a seamless transition post-acquisition.

2. Target Identification/Fit Assessment

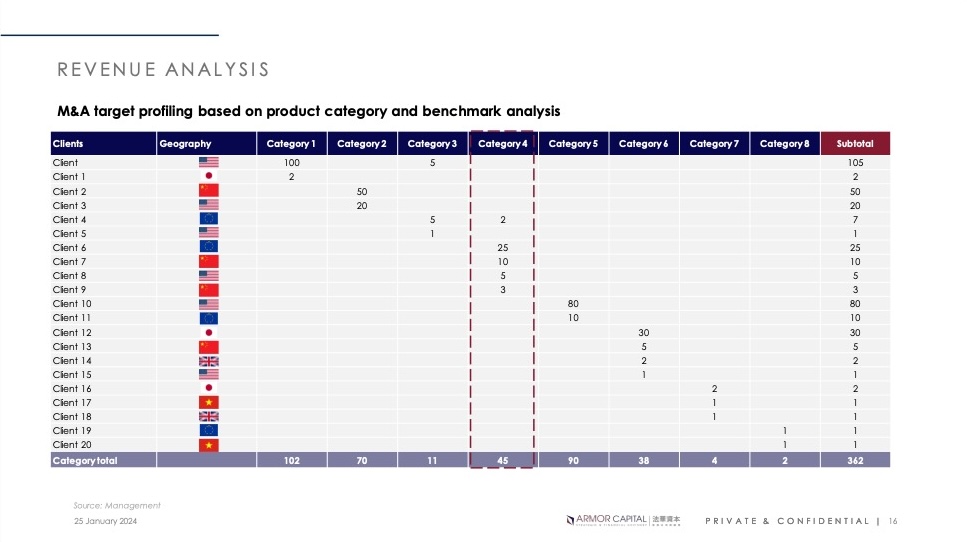

At Armor-Capital, we collaborate with your executive team to define/ refine acquisition criteria based on your company’s strategic goals, including but not limited to industry, sub-sectors, geographical location, technological requirements & scale, culture, and potential synergies. Clarifying these criteria sharpens the focus and enhance the effectiveness for identifying suitable acquisition targets.

Based on a set of well-defined criteria, we set out to identify suitable acquisition targets through accessing numerous industry database, as well as tapping into our proprietary export network.

Next, we will reach out to the owners/key personnel of the short-listed targets. Engaging in Q&A sessions provides deeper insights into targets’ operations, challenges, and opportunities. This aids in understanding their business model, market position, and competitive advantages to ensure alignment with your company’s acquisition criteria.

During due diligence, we examine a company's financial history, projected performance, and compliance, reviewing statements, contracts, industry reports, and key documents. Using a secure Virtual Data Room (VDR), we ensure confidential storage and controlled sharing of sensitive information. This comprehensive evaluation provides essential insights for confident acquisition decisions.

3. Execution & Post Merger Integration

We assist in drafting and issuing a compelling Letter of Intent (LOI), presenting your intentions clearly and professionally to potential sellers.

Our team engages in strategic negotiations, advocating for your interests, discussing terms, and ensuring alignment for a favourable acquisition deal.

We manage the development of a detailed Sale and Purchase Agreement (SPA) while assisting you through the closure phase, ensuring a seamless transfer of ownership and fulfillment of legal requirements.

We aid in developing an integration strategy, ensuring a seamless amalgamation of the acquired entity into your operations. This includes cultural integration, operational synergy realisation, and maximising the value derived from the acquisition

M & A Timeline

M&A Review and Analysis

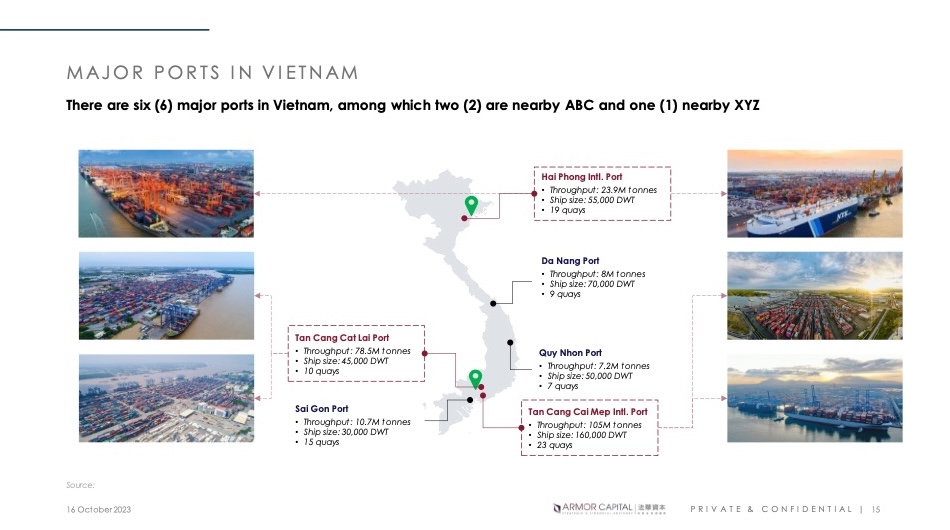

- Reviewing any target country – market analysis

- Strategic review of the business to better define target’s criteria before engaging

Stay up-to-date with Armor Capital?

Subscribe to our newsletter with occasional emails about news, investment and portfolio updates.

We do not spam and you can unsubscribe anytime.