Press Releases

- Article

APAC Software Industry Report H2 2020

March 3, 2020

Introduction

We are pleased to share with you a summary update of market valuations and activities in the Asia Pacific Software industry for the second half of 2019.

Software is one of the key sectors in which Armor specializes and closely follows market trends. Please contact us for a further discussion.

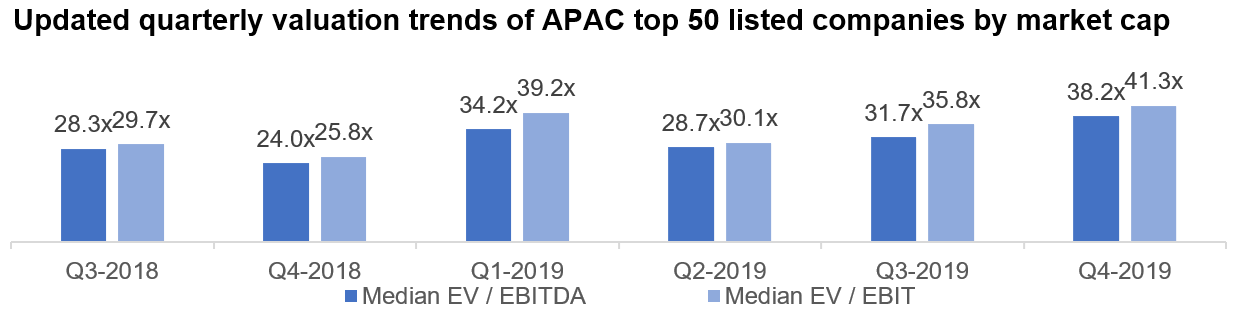

Valuations of Asia Pacific’s public companies have increased over H2 2019 compared to the same period in 2018. Median EBITDA was 38.2x by the end of Q4-2019 vs. 24.0x in Q4-2018 – an increase of nearly 60% year-on-year.

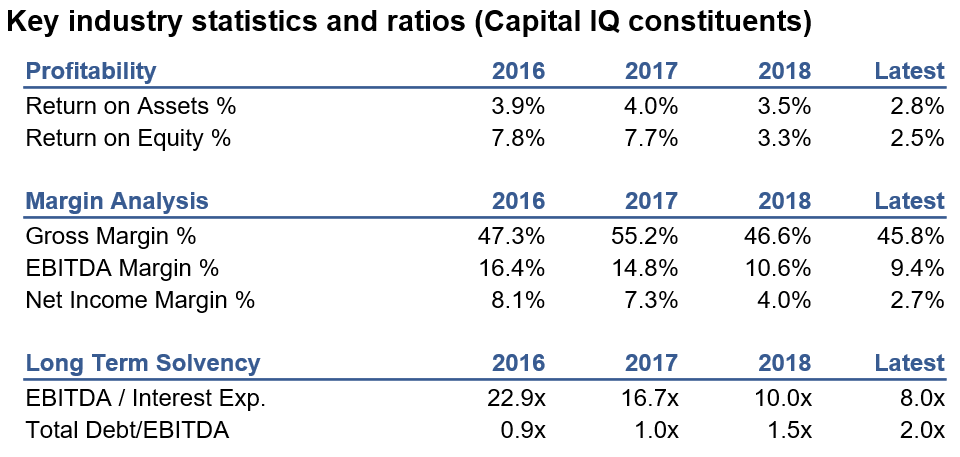

Key highlights from the above table are that margins have narrowed since 2016. Over the same period, leverage of the industry constituents has increased.

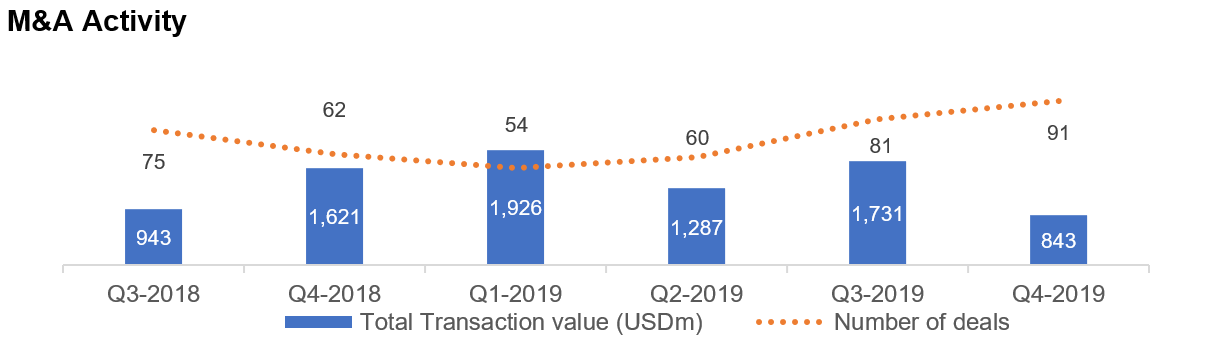

M&A activity by volume has been relatively consistent over the last 6 quarters with c. 60-90 transactions (majority stake only) per quarter. Most of deals were in the lower mid market segment, while 1 to 2 transaction drove most of the total transaction value.

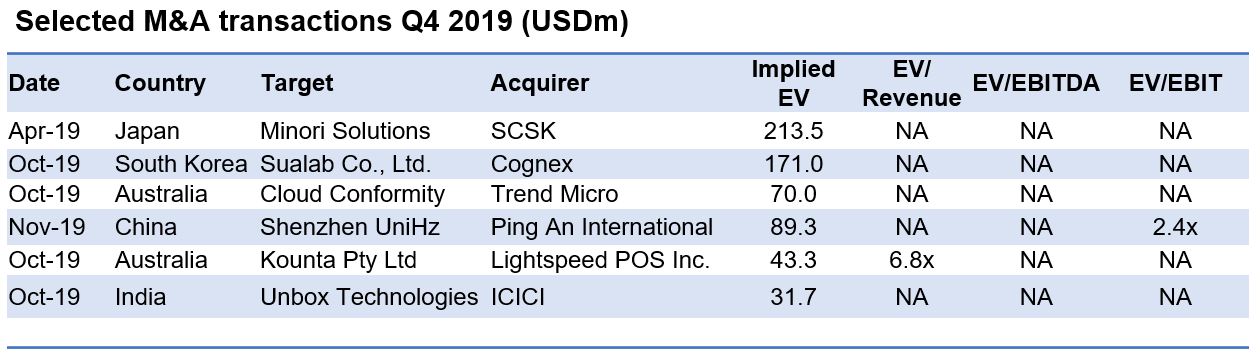

Armor selected the largest M&A transactions across the region in 2019 H2 for which information on Implied Enterprise Value was available. The acquisition of Minori Solutions Co., Ltd. was the most remarkable transaction so far for Q4 2019.

Software is one of the key sectors in which Armor specializes and closely follows market trends.

Please contact us for an in-depth discussion via enquiry@armor-capital.com