Press Releases

- Article

APAC Education Industry Report H1 2019

October 21, 2019

Introduction

We are pleased to share with you a summary update of market valuations and activities in the Asia Pacific education services industry for the first half of 2019.

Education is one the key sectors in which Armor specializes and closely follows market trends. Please contact us for a further discussion.

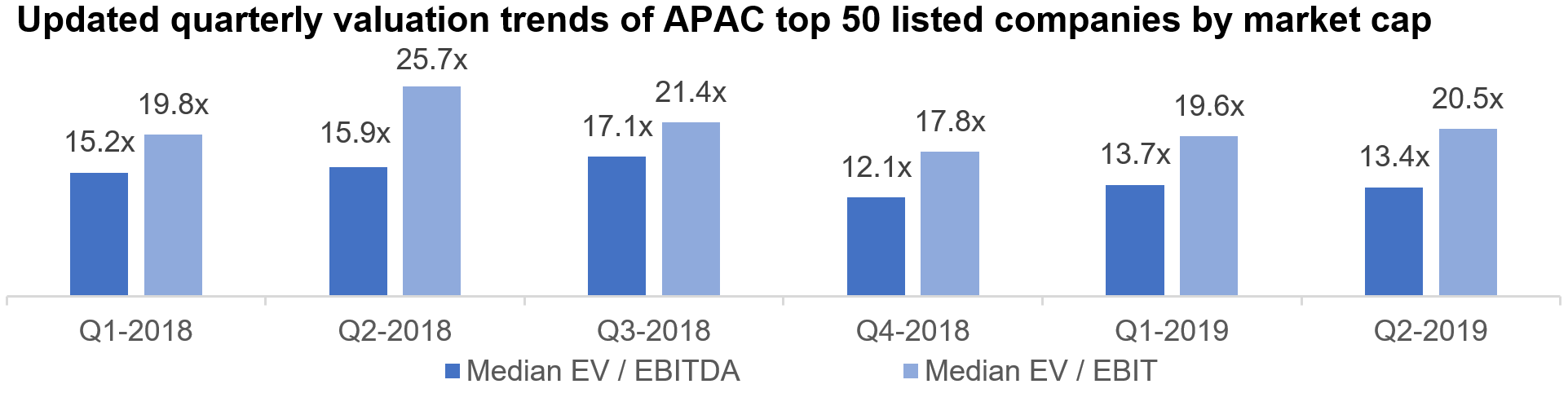

Valuations of Asia Pacific’s public companies were lower over last 3 quarters ending June 2019. EBITDA multiples were over 15% lower by the end of Q2-2019 (13.4x in Q2-2019 vs 15.9x in Q2-2018).

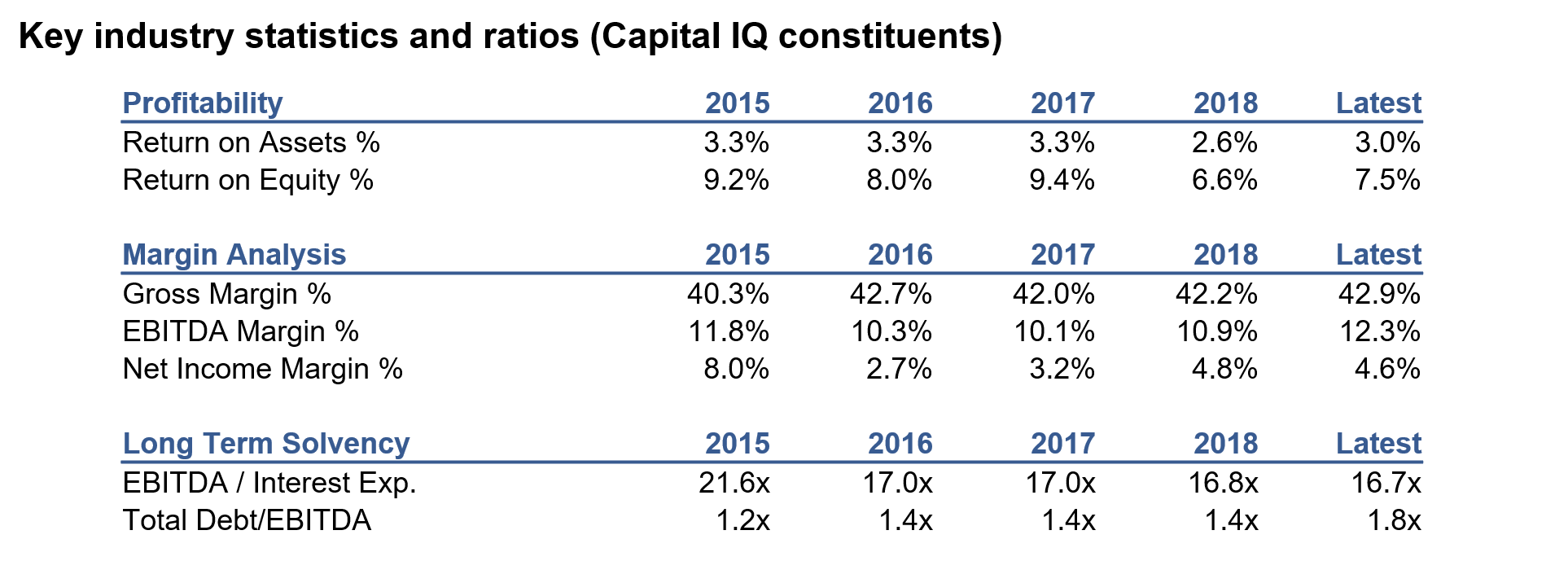

Based on around 250 selected companies, the table above illustrates that industry returns and companies margins have been quite stable over the past five years. By contrast, companies’ leverage ratios did not remain stable and we observed an increase (+23% in average between 2015 and end of October 2019) in debt over the period.

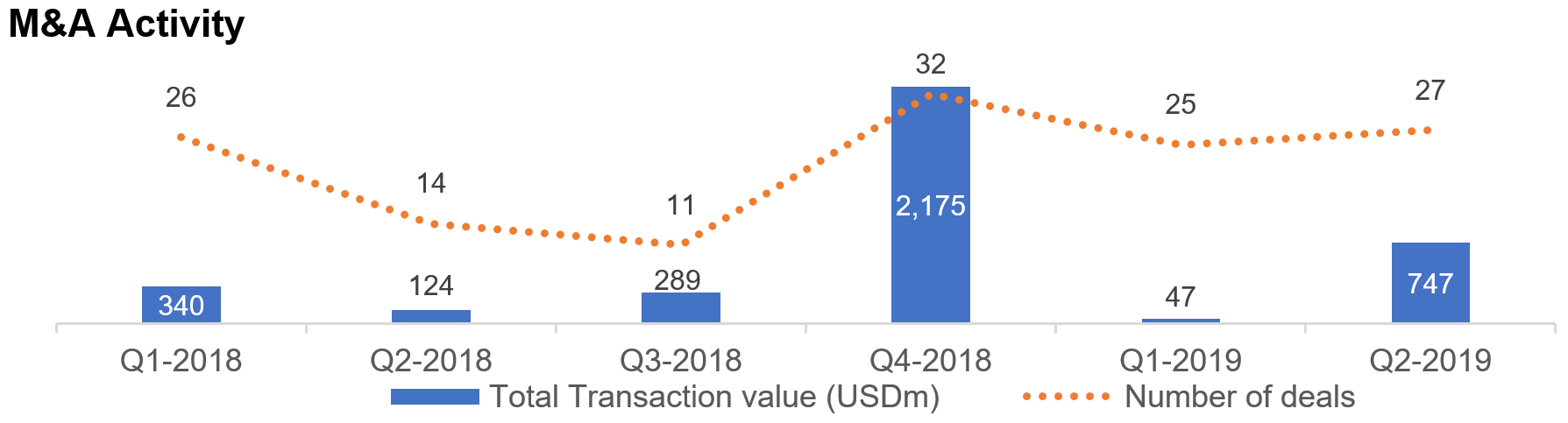

While Q2-2018 and Q3-2018 were characterised by a slowdown in M&A deal count, Q4-2018 saw a few mega-deals (e.g. Navitas Limited – EV USD 1,649m) pushing up the total transaction volume. Although we observed smaller sized transactions in Q1-2019, the total transaction value is higher in H1-2019 vs H1-2018 (USD 794m H1-2019 vs USD 464m H1-2018).

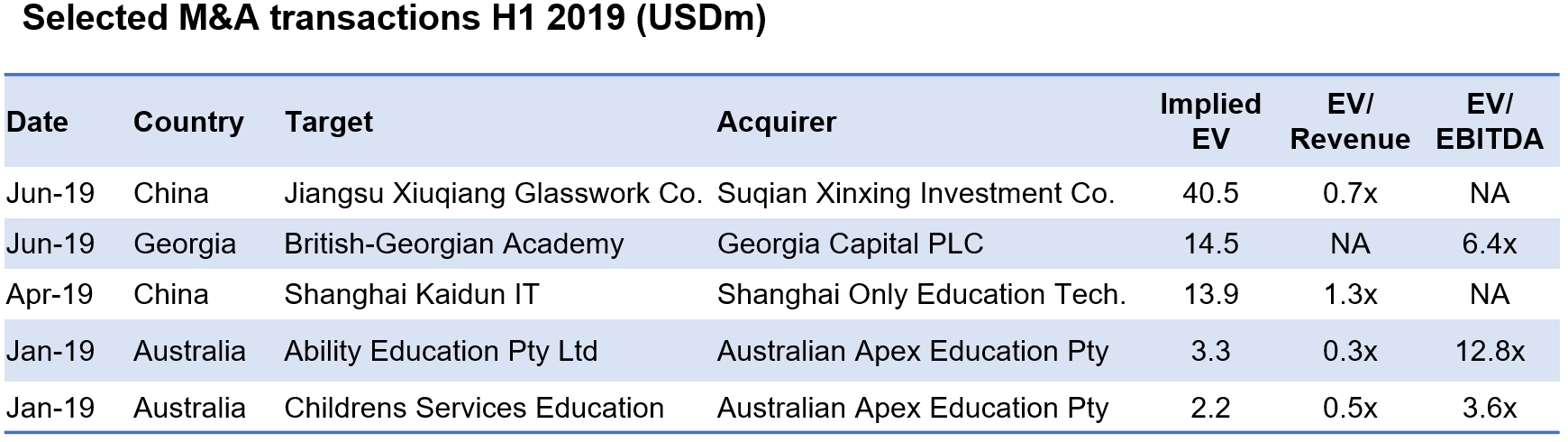

Armor selected the largest M&A transactions across the region in 2019 H1 for which information on Implied Enterprise Value (EV) was available.

Education is one the key sectors in which Armor specializes and closely follows market trends.

Please contact us for an in-depth discussion via enquiry@armor-capital.com